October is known as a bear market killer, as many bear markets have ended during this month. Some of the most famous were the 1974 and 2002 bears, which both ended within the first two weeks of October. Those bears were down more than 48% and 49%, respectively, when the ultimate lows took place. In recent history, tradable lows have taken place in October in 1962, 1966, 1990, 1998, and 2011 before strong end-of-year rallies.

- Last week showed some hallmarks of a stock market bottom.

- Don’t ignore the fourth quarter’s strong start, as the potential for a year-end rally is there.

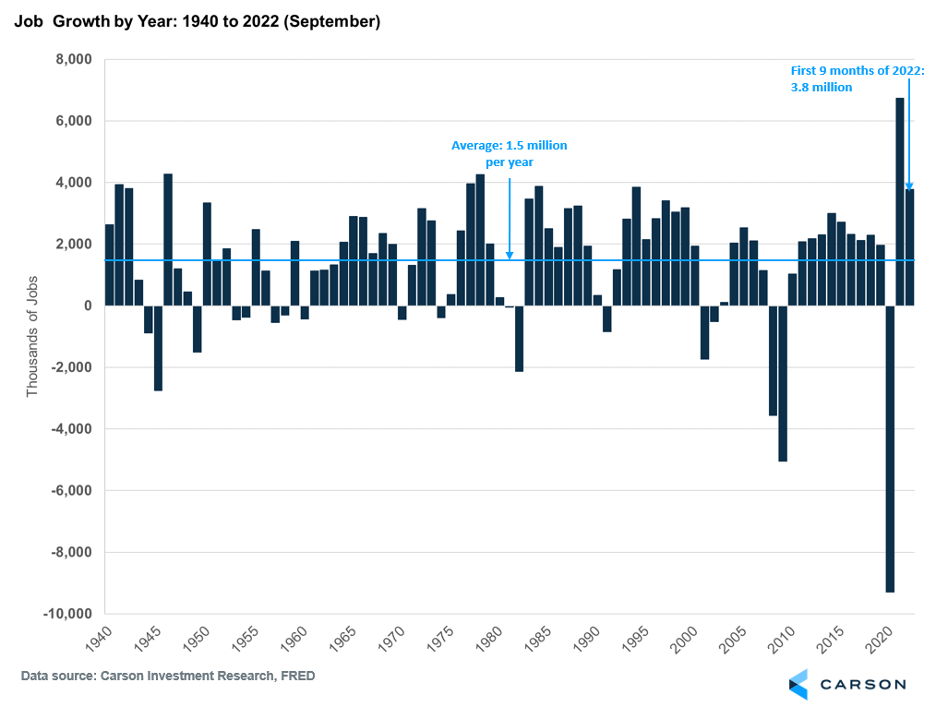

- The labor market remains strong and resilient; 263,000 jobs were added in September, sending the year-to-date total to 3.8 million.

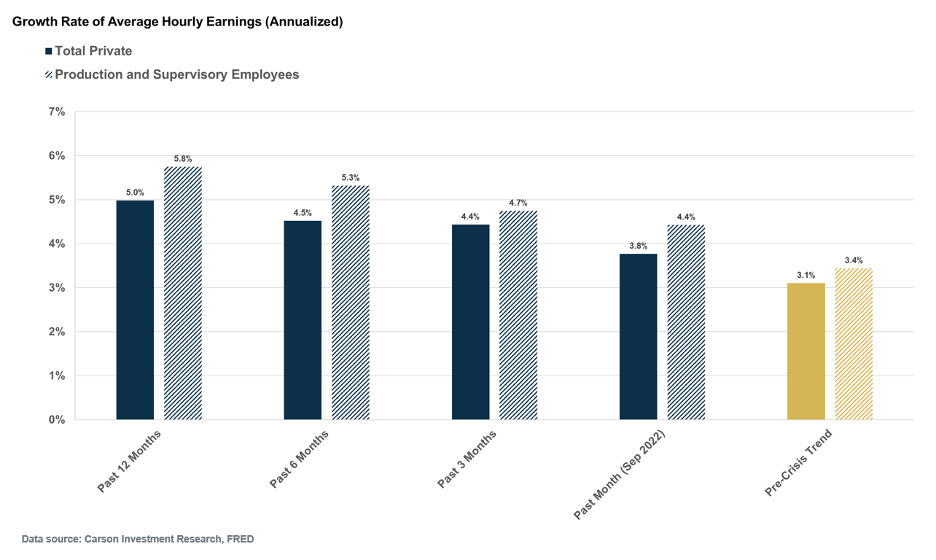

- Decelerating wage growth should ease inflationary pressures.

- The Federal Reserve remains committed to raising interest rates, at least until official inflation data reverses in a convincing way.

This year could follow suit. The market may have hit bottom on the last day of September, as the S&P 500 soared 5.7% to kick off October, marking the best start to a new quarter since 1938. Those types of gains typically take place after bear markets have ended. Other times the markets have jumped 5% in two days: March/April 2020, December 2018, August 2015, August 2011, and March 2009. Those dates might ring a bell with investors as all were major turning points before strong price action. Yes, there were many incorrect signals in late 2008, as stocks continued to crash into March 2009. But we do not think we are in that type of environment, and the incredible strength to kick off October could be a signal better times are coming.

The Fourth Quarter is Finally Here

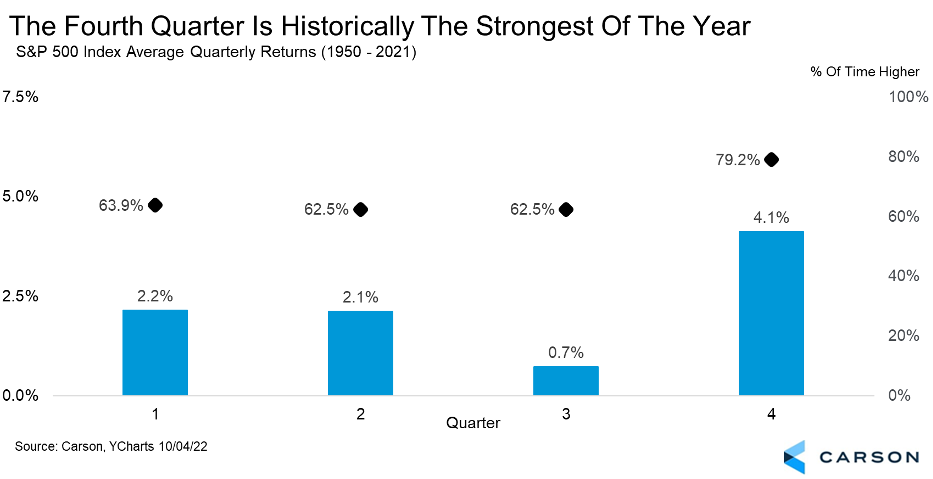

The fourth quarter is indeed the best of the year.

- The chart below shows the fourth quarter gains 4.1% on average and is higher nearly 80% of the time.

- 2022 saw the third worst start to a year ever. Only 1974 and 2002 were worse at the end of September, and both years saw early October lows and gained 7.9% in the fourth quarter. Of the 10 worst starts to a year, the fourth quarter was higher nine times and up a median of 7.9%.

- When September has been down more than 7% (like 2022), the fourth quarter has closed higher five of the past six times.

A Resilient Labor Market

There’s been no end to bad news and negativity this year, but employment has been a lone bright spot. True to this year’s form, the September payroll report continued to show strength and resiliency. The economy created 263,000 jobs in September, which was slightly higher than expected. Over the past three months, the economy has created more than 1.1 million jobs. Entire years rarely see that amount of job creation, let alone three months. All in all, 2022 has been a massive year for the labor market, with payrolls growing by 3.8 million over the first nine months, putting it ninth on the list for annual job creation since 1940. And the year is not done yet.

The unemployment rate also fell in September from 3.7% to 3.5%, which matches the pre-crisis low and is also the lowest level in more than 50 years. It is the reverse of what Federal Reserve officials and economists predicted would happen in the face of tighter monetary policy. Of course, we’re just a few months into the beginning of the interest rate hiking cycle and unemployment could rise.

Another positive was the fact that average hourly earnings growth eased. As the following chart illustrates, the pace of wage growth has now been easing quite consistently for several months, and this has occurred even for non-managerial or “production and non-supervisory” workers. Non-managerial workers typically have lower incomes and tend to spend a greater portion of their wages, thus fueling demand. So, the slowdown in wage growth could potentially lower demand and reduce any related price pressure.

What Does This Mean for the Federal Reserve?

On the face of it, easing wage growth should push inflation lower. However, the Fed is unlikely to hit the pause button, let alone reverse interest rate hikes, until the official inflation data softens in a convincing way. In fact, several Fed officials pointed out last week they are inclined to continue raising rates and are not close to any sort of pause. September’s strong payroll report, with falling unemployment, was probably viewed by markets as added impetus for the Fed to continue increasing rates. This obviously increases the risk that the Fed could tighten policy too far and send the economy into a recession.

The good news is several private measures of prices, including rents and used cars, are already decelerating. We believe it will just be a matter of time before this shows up in the official inflation data. It is a race of sorts — how quickly the inflation data can reverse before the economy starts to weaken in the face of tight monetary policy. For now, every additional month in which the economy and employment remain resilient buys more time for the official inflation data to decline. And to that end, September payroll data was positive in more ways than one.

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 – A capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The NASDAQ 100 Index is a stock index of the 100 largest companies by market capitalization traded on NASDAQ Stock Market. The NASDAQ 100 Index includes publicly-traded companies from most sectors in the global economy, the major exception being financial services.

Compliance Case # 01512253