The S&P 500 dropped 5.7% last week and is now 22.3% off its peak. This decline pushed the index of large-cap U.S. stocks into a bear market, which is defined as a 20% or greater drop from its peak. Volatility remained elevated, and the S&P 500 has now moved by 1% or more 60 times this year.

Key Points for the Week

- The S&P 500 entered a bear market by closing more than 20% below its all-time high.

- The Federal Reserve raised rates 0.75% as the central bank plays catch up after leaving rates too low for too long.

- U.S. retail sales slowed 0.3% last month in response to heightened inflation, while industrial production remained strong. Even with the decline, retail sales are up 8.1% from last year.

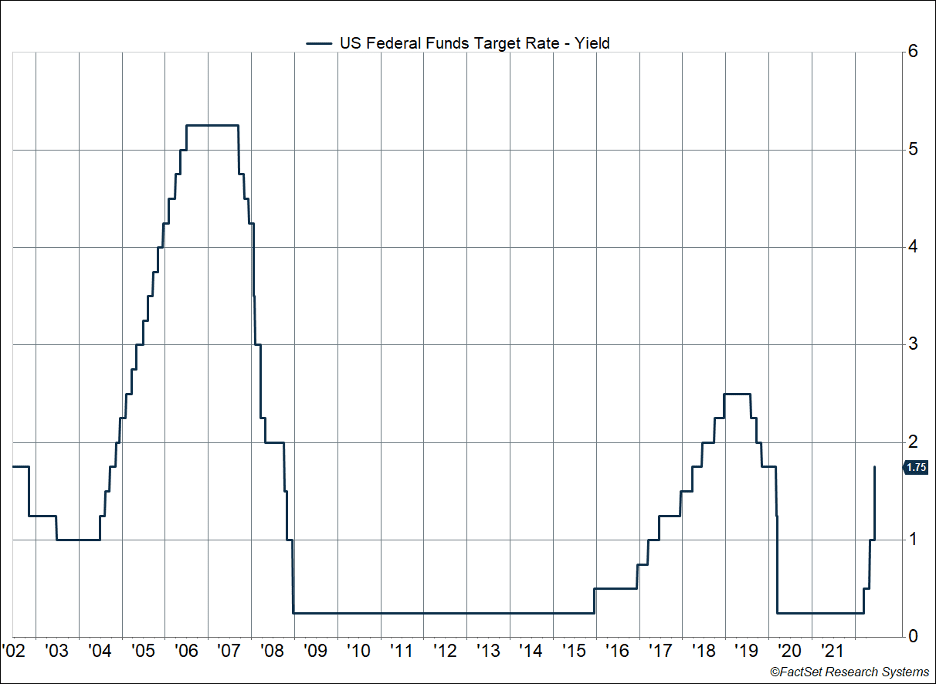

Much of the decline can be traced to the Federal Reserve raising rates 0.75%, signaling the central bank views more rapid action as necessary to tamp down inflationary pressures. With the hike, the Fed’s benchmark fund rate has a range of 1.5%-1.75%. It was the first time since 1994 that the Fed has raised 0.75% in one meeting. The Fed also raised its expectations for interest rates in each of the next three years, suggesting additional rate hikes should be expected (Figure 1).

Some economic data indicate the pressure on prices might be edging lower. Producer prices rose 0.8% last month but only 0.5% when food and energy is excluded. While up 10.7% in the last year, that is 0.9% lower than it was two months ago. Retail sales fell 0.3% last month. Consumers are pulling back from purchases in the face of higher prices.

Global stocks moved similarly to U.S. stocks last week. The MSCI ACWI also fell 5.7%. The Bloomberg U.S. Aggregate Bond Index shrank 0.9% as bond prices fell in response to the expectation of higher rates. A host of Purchasing Manager Index reports will be released this week and will help identify if economic activity remains strong.

Figure 1

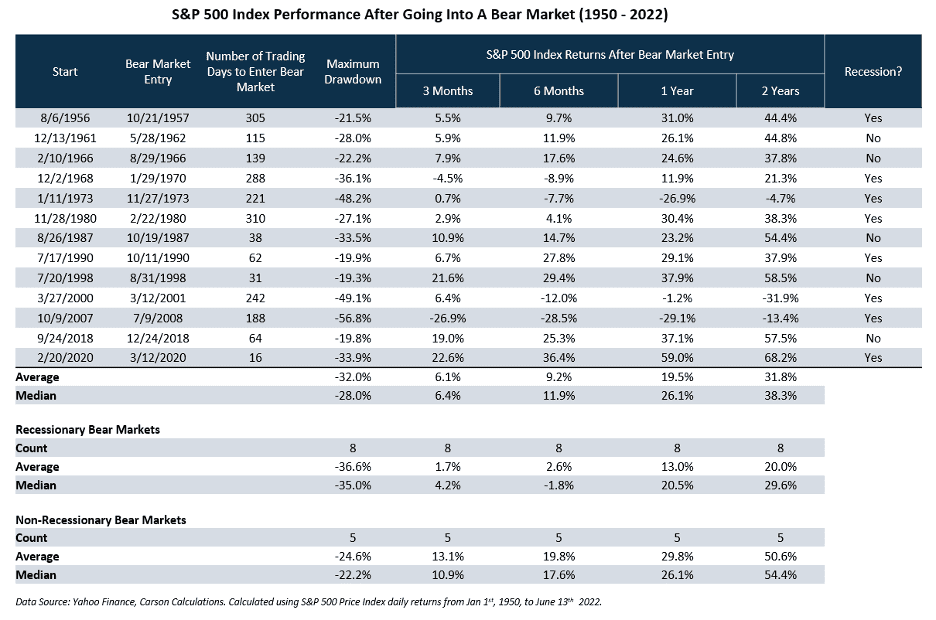

Figure 2

Bearing up to the Pressure

We are back in a bear market. After a couple of close escapes, the S&P 500 broke through the down-20% threshold and entered a bear market early last week. Unlike the COVID bear market in early 2020, this decline has taken a while. The S&P 500 peaked on Jan. 3, 2022, and has slid 22.3%, including dividends, from that peak. The decline has accelerated in recent months with the S&P 500 falling 18.6% in the second quarter.

Why did the markets drop? Inflation and the Fed’s interest rate hikes were the primary causes. Markets moved into last week still trying to digest the larger-than-expected inflation report from the previous Friday. The news didn’t go down easy and expectations for a 0.75% rate hike started to increase. Those expectations were fulfilled on Wednesday, when the Fed raised rates 0.75% for the first time since 1994.

The Fed moved aggressively because it delayed tightening monetary conditions and is trying to catch up (Figure 1). In its official statement, the Fed recommitted itself to getting inflation back down to 2 percent. By increasing rates, the Fed will make borrowing more expensive, and less borrowing makes the economy expand more slowly, reducing demand and allowing prices to decline.

The Fed faces a difficult challenge because rapid interest rate hikes can harm key segments of the economy and markets don’t have time to adapt to changing expectations. Markets dropped last week partly due to concerns the Fed will keep raising rates rapidly and push the economy into recession sometime next year. Fears of a recession next quarter seem overblown given the continued strength in labor markets.

The Fed isn’t the only central bank battling rapidly rising prices. Inflation is a global phenomenon and many countries have been increasing rates. Last week Switzerland and England both raised rates. The 0.5% increase in Swiss rates was a surprise to many while the English raised rates by 0.25% for the fifth straight meeting. Previously, the European Central Bank announced it would raise rates at its July meeting.

Given all this information, what should investors expect from the market? In the short term, markets are expected to stay volatile. There have already been 60 moves of 1% this year and those are likely to continue given the uncertainty. Inflation data, such as the Personal Consumption Expenditures Pride Deflator (PCE) and the Consumer Price Index, will likely have outsized impact. We will be paying close attention to communication from Fed governors about the future direction of rates. We’ll also be watching energy prices closely. Producer and consumer prices were pushed higher because of energy prices, and we expect prices in other areas indirectly affected by higher energy costs to rise.

In the intermediate term, the odds favor the patient investor. Averaging all the bear markets since 1955, stocks have increased 6.1% in the three months after a decline of more than 20%. The S&P 500 has increased an average of 19.5% one year after entering a bear market (Figure 2).

Markets often rally after entering bear markets because investors reach a point of high pessimism. During declines, it is easy to identify the challenges market face. The case for why things will improve is often more nuanced and less vivid. Yet, based on historical performance, the most realistic assumption is the market will recover eventually and patience is often the most important investor virtue. Anything you can do to stretch out your time horizon can help make investing less challenging and more rewarding. Please let us know if there is anything we can do to help you.

–

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

The Federal Reserve 06/15/2022. Federal Reserve issues FOMC Statement.https://www.federalreserve.gov/newsevents/pressreleases/monetary20220615a.htm

ING Snaps. 06/16/2022. Swiss National Bank raises rates by 50 bps.https://think.ing.com/snaps/swiss-national-bank-raises-rates-by-50bp/#:~:text=The%20SNB%20has%20revised%20its,the%20first%20quarter%20of%202024.

Eliot Smith. 06/16/2022.https://www.cnbc.com/2022/06/16/bank-of-england-hikes-rates-for-the-fifth-time-in-row-as-inflation-soars.html

Census Bureau. 06/15/2022. Advance Monthly Sales for Retail and Food Services May 2022.https://www.census.gov/retail/marts/www/marts_current.pdf

BLS. 06/14/2022. Producer Price Index News Release Summary.https://www.bls.gov/news.release/ppi.nr0.htm

Sylvan Lane. The Hill. Fed hikes by 75 basis points for first time since 1994.https://thehill.com/homenews/3524517-fed-hikes-rates-by-75-basis-points-for-first-time-since-1994/#:~:text=The%20Federal%20Reserve%20announced%20Wednesday,discouraging%20May%20surge%20in%20inflation.

Compliance Case #01408268