Stocks fell for the second consecutive week, but the losses were quite manageable. In the face of banking and economic concerns, stocks are holding the line. Stocks tend to lead the economy, so just because the economic headlines are poor now doesn’t mean they will be in the future. Stocks tend to sniff out better times, and we continue to believe the economy will surprise to the upside the second half of this year.

- Stocks continued to hang tough last week in the face of economic and banking worries.

- A rare bullish signal was triggered, which could suggest higher prices.

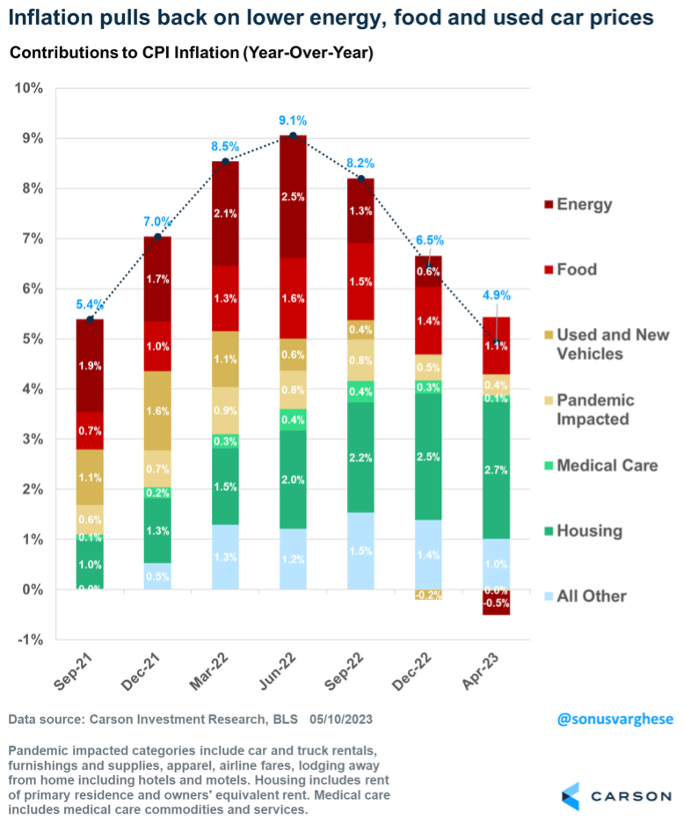

- April CPI inflation data came in as expected, but we now see a clear path to lower inflation.

- Energy, food, and used car prices have pulled inflation down from 9% in June 2022 to 4.9% in April 2023.

- Core inflation remains elevated, mainly due to above-average housing inflation.

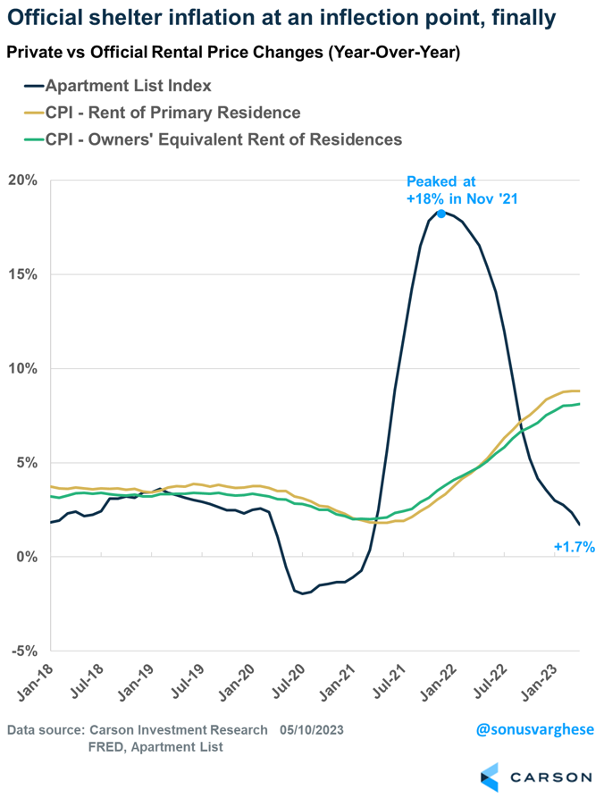

- The good news is housing inflation appears to be at an inflection point and is likely to drive core inflation lower in the second half of 2023.

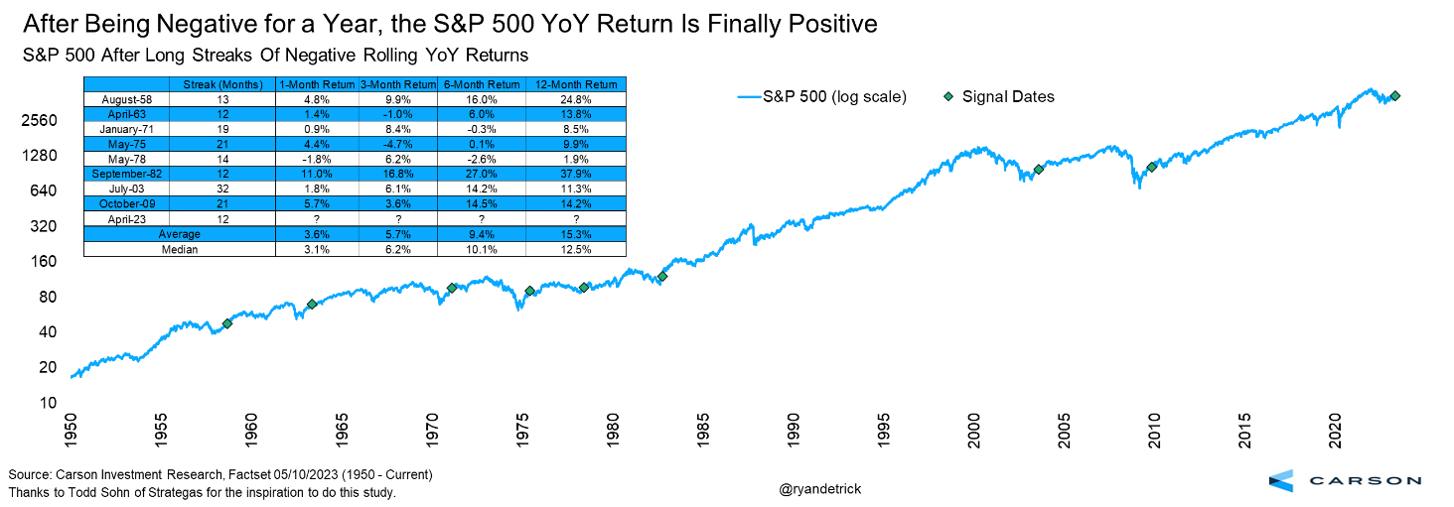

Stocks just turned positive on a year-over-year basis as of the end of April. This matters as the S&P 500 had a negative year-over-year return for 12 months in a row before finally turning positive last month. We reviewed previous examples of the stock market going at least 12 months with negative year-over-year returns, and sure enough the future returns could have the bulls smiling. A year later, stocks were up every time and gained more than 15% on average.

A Clear Path to Lower Inflation

April’s CPI inflation data came in at expectations. Headline inflation rose 0.4% and is now up 4.9% over the past year. That is well below the peak rate of 9.1% last June. The big picture is inflation has already pulled back in a big way. That is primarily because of lower energy prices and a welcome decrease in food prices. Used car prices rose in April but have been on a downtrend since last summer, contributing to the pullback in inflation. New car price inflation appears to be easing now, too.

Excluding food and energy, core inflation is now running higher than headline inflation, at 5.5% over the past year. That’s not far below last summer’s peak of 6.6%, and so the pullback in headline inflation hasn’t quite translated to the core measure. Core inflation is also what the Federal Reserve typically focuses on, and from that perspective, inflation remains well above the Fed’s target 2% rate.

The main reason behind elevated core CPI inflation is housing inflation, which makes up 41% of the basket. Housing inflation, which is basically derived from rents (as opposed to home prices), has been running hot, around 8-9% over the past year.

This is in sharp contrast to market-based rental price measures, which have shown a sharp deceleration in rents over the past year. Apartment List’s national rental index peaked at 18% about 18 months ago, but that has decelerated to a 1.7% pace as of April. The official shelter index clearly has a significant lag to this market-based index. But here’s the good news: The official data looks to be at a turning point.

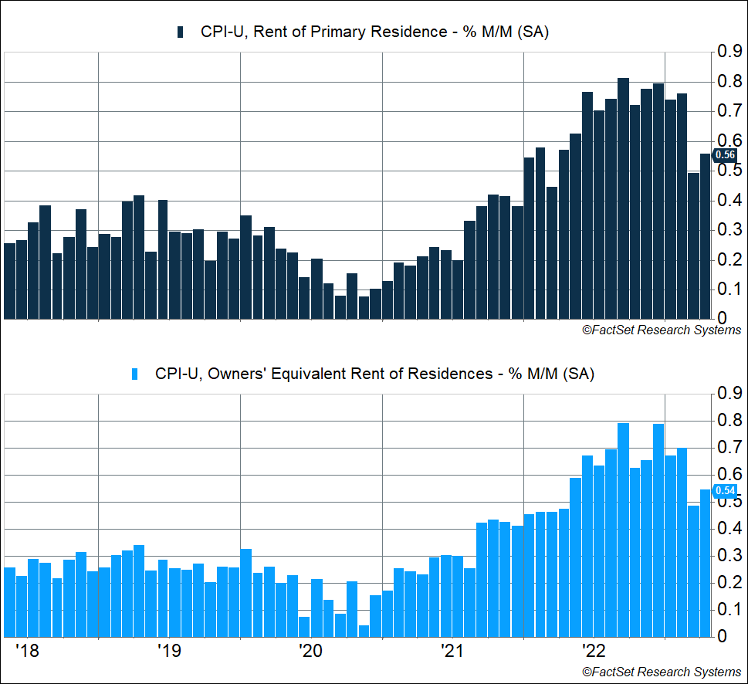

On a month-over-month basis, rents had been increasing at an average rate of more than 0.7% between June 2022 and February 2023. But that has decelerated to an average rate of about 0.5% over the last two months, which is a very positive sign. However, as the chart below shows, that’s still higher than 2018-2019 when monthly increases averaged about 0.3%.

In short, the official housing inflation data is decelerating, but there’s still some ways to go. We’re likely to get closer to the pre-pandemic pace as we move into the second half of 2023, and that will also pull core inflation lower. That would be more than welcome, especially since it should ease the Fed’s concerns about inflation running above target.

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 – A capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The NASDAQ 100 Index is a stock index of the 100 largest companies by market capitalization traded on NASDAQ Stock Market. The NASDAQ 100 Index includes publicly-traded companies from most sectors in the global economy, the major exception being financial services.

A diversified portfolio does not assure a profit or protect against loss in a declining market.

Compliance Case # 01764264