The S&P 500 ended its string of seven negative weeks by rallying 6.6% last week. The surge in stock prices gave the index some margin between its current price and the 20% decline the index flirted with just two weeks ago. After the rally, the S&P 500, including dividends, is down 12.8% from its record high.

Key Points for the Week

- The S&P 500 soared last week after seven consecutive weekly declines.

- The Federal Reserve’s minutes confirmed expectations for at least two more rate increases of 0.5%.

- Core PCE inflation increased 0.3% for the third month in a row. While above the Fed’s target, inflation is slowing from its recent peak.

The Federal Reserve’s minutes from its last meeting confirm the Fed expects to raise rates 0.5% the next two meetings and then evaluate how inflation has changed. The minutes didn’t provide any surprises and reassured investors that they are reading the Fed’s intentions well.

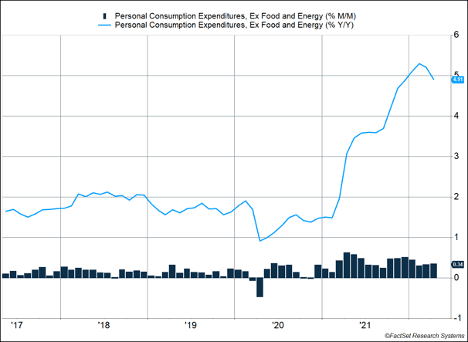

PCE (personal consumption expenditures) inflation data provided markets a boost by indicating the slowing inflation trend in the Consumer Price Index was confirmed in the PCE data as well. Core PCE inflation, which excludes food and energy, increased 0.3% for the third consecutive month, and the yearly gain dipped below 5% (Figure 1). Inflation, including food and energy, was even lower because fuel prices fell in April. Next month, we expect inflation to jump because of higher fuel prices. We will watch core inflation to see if the trend toward slower inflation continues.

Broader economic conditions remain strong. Durable goods orders climbed 0.4% and business investment rose 0.3% last month. Companies are likely ramping up investments in machines and other labor-saving devices to combat high wage growth.

Global stocks rallied with the S&P 500. The MSCI ACWI leapt 5% The Bloomberg U.S. Aggregate Bond Index gained 0.8%. The U.S. employment situation leads the list of key economic reports this week. We’ll be paying attention to the overall job gains and how quickly wages are climbing.

Figure 1

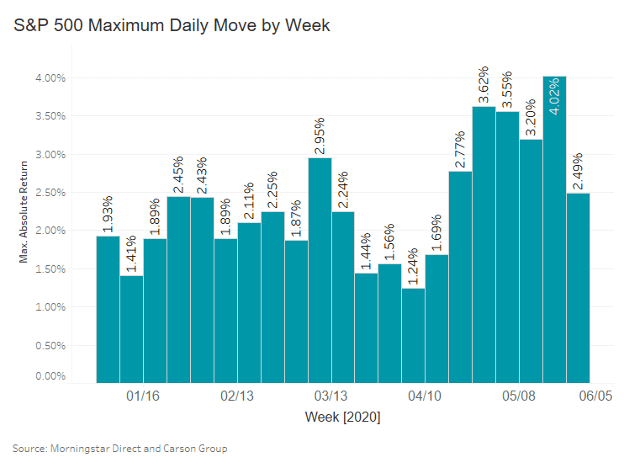

Figure 2

Figure 3

Rally Caps

What causes markets to reverse direction so rapidly after seven weeks of decline? The S&P 500 pole-vaulted (jump doesn’t seem quite strong enough) 6.6% higher last week after barely avoiding a bear market the week before. Our comment last week that “…value is improving, and the seeds of the next market rally may have already been planted,” looks pretty good in retrospect, but we certainly didn’t forecast a 6.6% rally.

Last week’s rally was likely caused by a number of factors aligning to send markets higher. Let’s review:

- Investment managers love to talk about having “dry powder,” which can be deployed if a market decline creates an opportunity to buy something cheap. What they don’t mention as often is they sometimes wait for signs the selling pressure is abating before jumping in. When selling slows and buyers sense an opportunity, markets can move quickly. After seven weekly declines, some investors had likely found stocks attractive.

- The Federal Reserve continued to make its intentions clear to the market. The minutes from the most recent meeting earlier this month showed nearly full agreement on the plan to increase interest rates by 0.5% in each of the next two meetings in June and July. This would put the federal funds rate between 1.75% and 2%, which is a large increase from where it started the year, at 0.25%, but not as high as some feared. After the two additional 0.5% hikes, some Fed members prefer to reassess if more hikes are needed, while others want to keep raising rates.

- Core inflation, which excludes the volatile effect of food and energy prices, came in at 4.9%. This is still a lot higher than the Fed’s target of 2% but is a decline from the previous month, which showed a 5.4% increase. The threat of higher rates and other factors have already started to slow inflation (Figure 1).

- Economic data released last week showed a recession may be further off than some feared. New orders for durable goods (products with at least three years of life expectancy) have remained strong, rising 0.4% month-over-month following March’s 0.6% increase. Six of the last seven months have been positive. As a leading economic indicator, durable goods continue to signal that the U.S. economy remains healthy. Additionally, new orders for nondefense capital goods ex-aircraft, which is a proxy for business investments, continue to rise, coming in with 0.3% month-over-month and 7.5% year-over-year gains.

- S&P 500 companies are investing in technology to help combat the ongoing labor shortage. Capital expenditures are currently 23% above pre-pandemic levels — indicating companies see higher demand continuing. After dropping sharply in the initial stages of COVID-19, capital expenditures surpassed the previous high in 1.5 years and have now surged past previous levels (Figure 2). In 2008, it took nearly twice as long to for capital expenditures to recover.

None of these factors were overwhelming, but the combination of better economic data and a kinder-than-expected Fed contributed to the gains.

Will markets finally calm down? Our expectation is they will not. The risks of stubborn inflation, an overaggressive Fed, and a possible recession all declined last week. But they didn’t go away. Also, markets remain volatile. There has been a 1% move every week this year, and big moves to the upside can reverse quickly. Upside volatility still counts as volatility and suggests investors can switch their sentiments quickly. The daily swings in the last weeks also suggest the market remains volatile. The last six weeks have experienced some of the biggest daily moves (Figure 3). This market is likely capped in how far it can run until better inflation data signal the macro risks are decreasing. Then volatility may start going down.

–

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

https://www.census.gov/manufacturing/m3/adv/pdf/durgd.pdf

https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20220504.pdf

Compliance Case #01387329