After the 11th best start to a year for the S&P 500 as of Valentine’s Day, stocks have pulled back during the second part of February in what we would classify as perfectly normal price action. The best three months of the year for stocks are November, December, and January. That means February tends to be the hangover month — the price to pay after too much fun.

- The hangover month of February is over, and we’re once again entering a period of positive seasonal trends.

- A return of more than 5.5% for the S&P 500 through early March is on pace with historical gains.

- Bond yields have risen thanks to the Fed’s aggressive actions, and that has raised concerns about the relative attractiveness of stocks.

- Our analysis suggests the premium for investing in stocks over bonds remains attractive, albeit lower than it was before the pandemic.

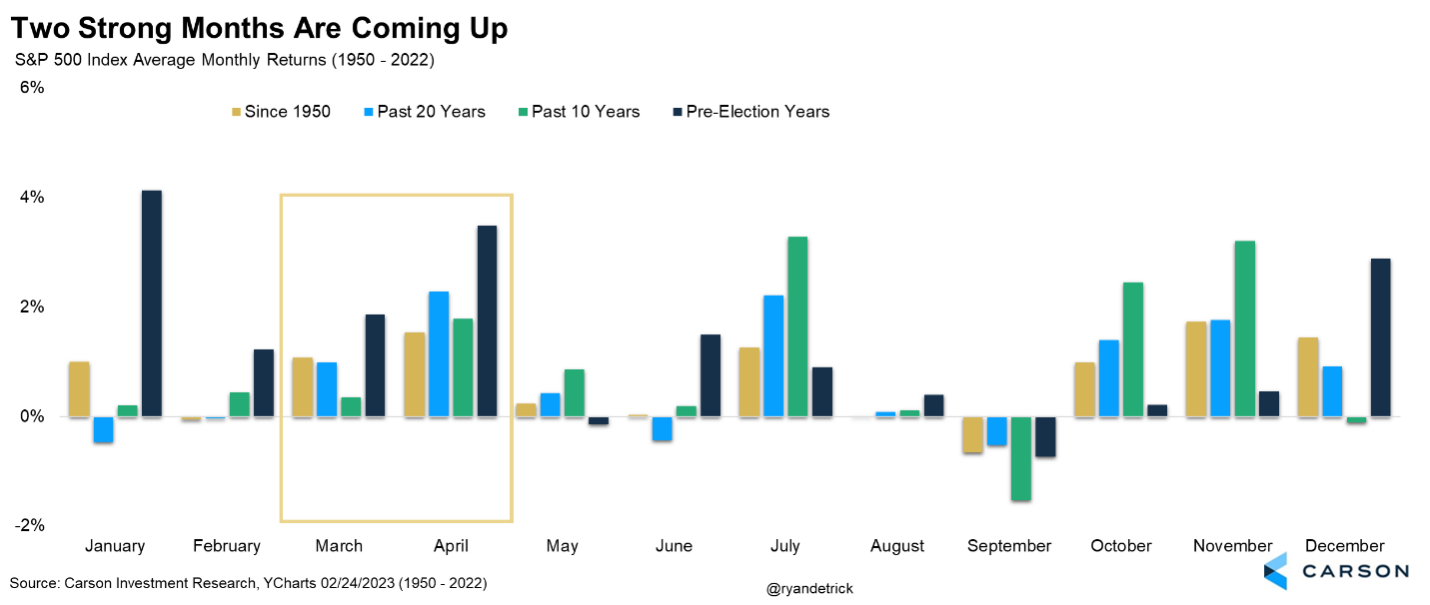

After the nearly 17% rally off the October lows into mid-February, some type of hangover or indigestion made sense. The good news is we don’t expect this weakness to last much longer. March and April are historically two of the strongest months of the year, but they do even better in pre-election years. Since 1950, the S&P 500 has gained 1.1% in March, while April has been up 1.5%. But in a pre-election year those returns go to 1.9% and 3.5%, respectively.

We are also encouraged by how quickly investors have become bearish again. After the great start to the year, many bulls were getting loud, and some longtime bears were starting to sound bullish. This increased the odds of a pullback. But now that we’re in the middle of a pullback, investors have turned extremely worried just as quickly and sentiment is showing signs of pessimism. From a contrarian point of view, we like to see this type of skepticism. Amid weakening price action, we would not want to see more bulls. But that sure isn’t happening today.

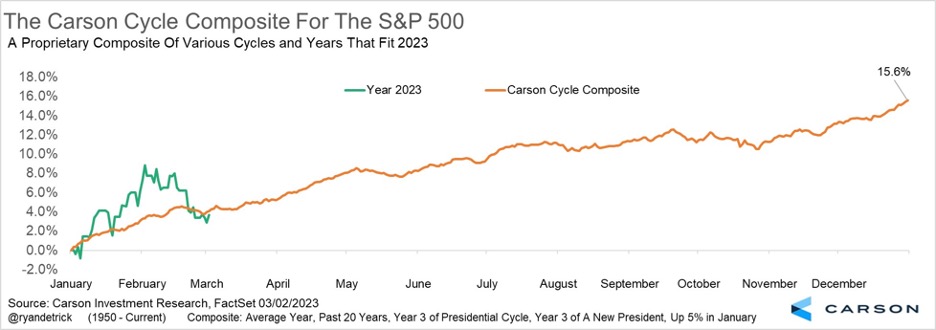

The chart below is based on a Carson proprietary composite for the S&P 500 reviewing various cycles, including the presidential election cycle. The Cycle Composite annual return is 15.6%. As of early March, 2023 is keeping pace with historical trends, i.e., a return of about 4%.

Why Should I Invest in Stocks When Bond Yields are High?

TINA, or “There is No Alternative,” was the theme of the last decade as interest rates were close to zero. Yields on long-term bonds weren’t much above that. So, stocks were the only alternative if an investor wanted reasonable returns.

But now there is an alternative, thanks to the Federal Reserve’s aggressive rate hikes. CREAM, or “Cash Rules Everything Around Me,” looks attractive enough to replace TINA.

Three-month Treasury bills, the best proxy for a liquid and “risk-free” asset, currently yields about 4.9%, while 10-year Treasury notes yield around 4%. These yields are tempting, more so because we haven’t seen anything like them in 15 years.

Consider stocks on the other hand. And instead of dividend yields, let’s look at earnings yields. Earnings yields that are corrected for cyclical effects are good predictors of long-run real returns for stocks (more on the “real” part below). If a company paid out all earnings as dividends, then the earnings yield would equal the dividend yield.

Earnings yield is basically the inverse of the price-to-earnings ratio. There are myriad approaches to estimating earnings, but let’s keep it simple. For example, if a stock is trading at $100 and its expected earnings per share over the next 12 months is $5, it has a forward P/E ratio of 20. And an earnings yield of 5/100 = 5%, meaning every dollar invested in the stock would yield 5 cents.

At the end of 2019, the S&P 500 was trading with a forward P/E of 18.5, i.e., with an earnings yield of 5.4%. That was pretty good considering that 10-year Treasuries were yielding about 1.7%. It implied an equity risk premium (ERP) of about 3.4%. ERP is the excess return investors require to hold risky assets such as stocks.

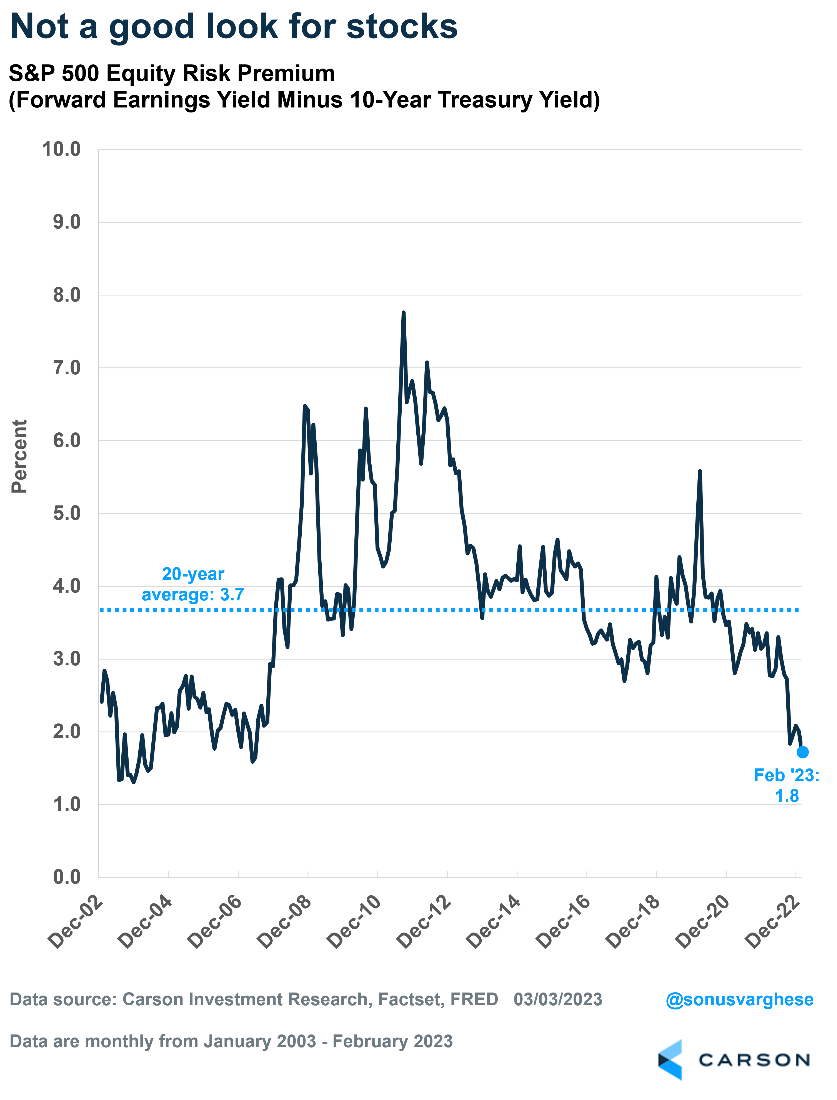

Right now, the S&P 500 is trading at a forward P/E of 17.5, which translates to an earnings yield of 5.7% and is a tad better than the pre-pandemic yield. The problem is that with 10-year Treasury yields around 4%, the implied ERP has seen a sharp compression, as the chart below shows.

That gets to the question: Why should I invest in stocks when risk-free yields are so high?

Not a Great Timing Tool

The ERP as calculated above is not a great indicator of future returns, let alone a timing tool that indicates when to hold stocks and when to shift to bonds. The last time the premium was as low as it is currently was in June 2007, when it was 1.6%.

- Over the following 10 years, bonds had an average annualized return of 4.5% versus 7.2% for the S&P 500, and that came despite a 50%+ pullback in 2008-2009!

- Over the following 15 years, bonds had an average annualized return of 3.3%, versus 8.5% for the S&P 500, and you had two massive pullbacks, in 2008-2009 and in 2020.

In any case, this approach to calculate the ERP has its faults.

Stocks are Real Assets

One problem with the above approach for calculating the ERP is that stocks are real assets whose prices rise with inflation. Also, corporate earnings move higher with inflation since companies can pass along rising input costs over time to their customers. As Jeremy Schwartz at WisdomTree points out, this pricing power is evidenced by the fact that long-term earnings and dividend growth have outpaced inflation (even during the 1970s and 1980s when inflation was high). Cliff Asness at AQR makes the same case here, arguing that the appropriate comparison is earnings yield to real risk-free yields, as opposed to nominal yields.

The picture looks a little better with that comparison, although the ERP using this approach is still lower than what it was pre-pandemic. That is because real risk-free yields, as measured by inflation-indexed Treasury bonds, have climbed sharply since then. The 10-year real yield was close to zero at the end of 2019 and fell as low as -1.2% in August 2021. The Fed’s aggressive rate hikes resulted in a dramatic upward shift in 2022, with the 10-year real yield currently around 1.6%.

The chart below shows ERP estimated using real yields. It’s fallen to 4.2%, but that’s still some serious premium.

So, don’t ignore stocks.

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 – A capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The NASDAQ 100 Index is a stock index of the 100 largest companies by market capitalization traded on NASDAQ Stock Market. The NASDAQ 100 Index includes publicly-traded companies from most sectors in the global economy, the major exception being financial services.

A diversified portfolio does not assure a profit or protect against loss in a declining market.

Compliance Case # 01680489